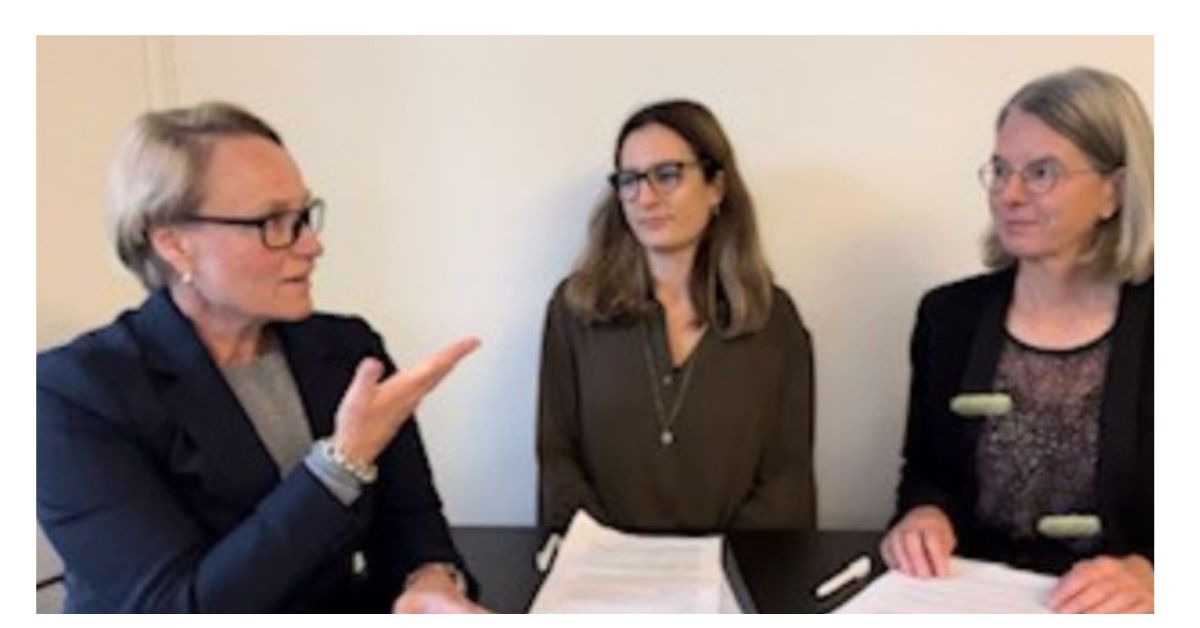

Tips for international companies establishing in Sweden! Video with Jolande & Ylva at Global Goes Local.

I am Karin from Beyondo. We work with the recruitment of international talents, and also assist international companies that wish to enter the Swedish market. I have invited Global Goes, Jolande and Ylva. They help international companies with the establishment and registration in Sweden and all related legal matters.

In this video, we will highlight useful information on regulations on how to enter the Swedish market.

What does a company need to think of when entering the Swedish market?

We recommend taking assistance from local experts for legal advice to establish and register a company in Sweden. Global Goes Local assists with establishing the Swedish entity and we can guide through the general legal questions and take in specialists and law firms when specialists are needed.

What are the most common legal forms in Sweden?

The most common legal forms are a limited liability company (Swedish “AB”) and a branch. It is important, before setting up the business, to understand the differences and similarities between a branch and a limited company. We also recommend to get in contact with a tax specialist to understand the tax situation, before setting up the business.

A lot of information, but what registrations need to be done?

A company or a branch needs to be registered with the Company Register, “Bolagsverket”. And once the company or branch is registered, with the company register, it also needs to register for income tax, VAT and as an employer, with the Swedish Tax Agency, “Skatteverket”.

And once registered as an employer, what do they need to consider in terms of recruitment in Sweden?

It is important to understand the local labour legislation in Sweden and what must be included in a Swedish employment agreement. For example, new labour law legislation was introduced on 1st October 2022. A Swedish employer also needs to understand what is required in terms of for example pension and insurance. We recommend contacting a labour law expert to assist with the employment agreement.

Thank you Jolande & Ylva at Global Goes Local for this useful information!

Read more on:

Legal forms of companies in Sweden.

Swedish Tax Agency/ Skatteverket

Swedish Company Register / Bolagsverket

Swedish Employment Protection Act (LAS)

Labour legislation/labour Unions